The Agrifood System Gets a Digital Makeover

THE PROBLEM

The global agrifood system, encompassing the production, distribution, consumption, and disposal of food, both contributes to and is negatively impacted by climate change. Today, agrifood value chain emissions equal about one-third of total global emissions and the Project Drawdown identifies food waste reduction as one of the most impactful ways to combat climate change. Emissions caused by agrifood include farmland conversion, livestock production, fertilizer and manure application/management, food waste, refrigerant management, and so much more. These emissions contribute to climate change impacts, such as changing weather patterns and climate events. These climate impacts negatively affect crop and livestock productivity, which in turn requires more agrifood activities, creating a positive and destructive feedback loop depicted below.

Impacts from climate change affect the agrifood system in different ways and magnitudes across time and space. Between 2008 and 2018, developing countries incurred crop and livestock production losses from climate-linked disasters of $108 billion. In the U.S., it’s estimated that by 2100 the Corn Belt will be unsuitable for the cultivation of corn. And in the nearer term, the corn belt will have higher likelihood of harvest failures due to hotter temperatures in the summer and excessive rain in the spring, which we’ve already seen in recent years.

There has recently been considerable attention on this sector, with COP27 highlighting the agrifood system in a major way for the first time, cultivating in the launch of the ‘123 Pledge’ for food loss. About $30 billion was invested in global agrifood in 2022, yet it’s one of the more unsolved pieces of the climate change solution puzzle.

AGRIFOOD EMISSIONS ARE HARD TO SOLVE FOR

Agrifood emissions have proven to be difficult for a number of reasons. Farmers are balancing an ever growing list of priorities, including balancing biodiversity, nutrition needs, and food security with their livelihoods. As emissions are growing, adaptation is required to keep productivity high in the face of changing weather patterns and events. And mobilizing the agrifood system to implement sustainable practices requires action from one-quarter of the global population who have varying priorities, constraints, and impacts.

Agrifood players are spread across the value chain, which we show below broken up by upstream, midstream, and downstream. Each section of the value chain has emissions associated with activities, yet where emissions lie does not line up with where value is created, measured by the USDA food dollars. One conclusion is that players who contribute most to emissions have the lowest ability to pay for solutions.

Note: The above emissions are associated with industrialized countries; developing countries have a different emissions profile.

DIGITAL REVOLUTION IN AGRIFOOD

Innovation in agrifood is nothing new, with historic innovations occurring in mechanics and genetics. This includes more efficient machinery, and more productive seed and fertilizers. However, starting with Monsanto’s acquisition of The Climate Corp in 2013, the sector is entering a digital-age. On-farm drivers for digital technologies stem from better risk management, higher productivity, and more efficient farm management, and can range from low-tech mobile applications to connected IoT solutions driven by AI/ML. Further down the supply chain, drivers for digital technologies include increasing consumer demands and the need for agrifood traceability and transparency. Although there is a trend towards digital and plenty of drivers pushing adoption, digital solutions have been slow to adopt.

Digital technologies have been slower to adopt in agriculture compared to other industries, stemming from lack of trust and being burned by agrifood startups in the past, among other factors. For current and future generations of digital technologies to be adopted, the value proposition should be centered on farmer’s real pain points, technologies need to have proven ROI in one growing season, be easily integrated into existing infrastructure, and should be appropriately de-risked.

CLIMATE RISKS IN AGRIFOOD

At Buoyant, we previously wrote about climate risk intelligence and the need to quantify the risk that climate change poses. This lens is particularly needed in the agrifood sector as impacts from climate change risks are spatially variable.

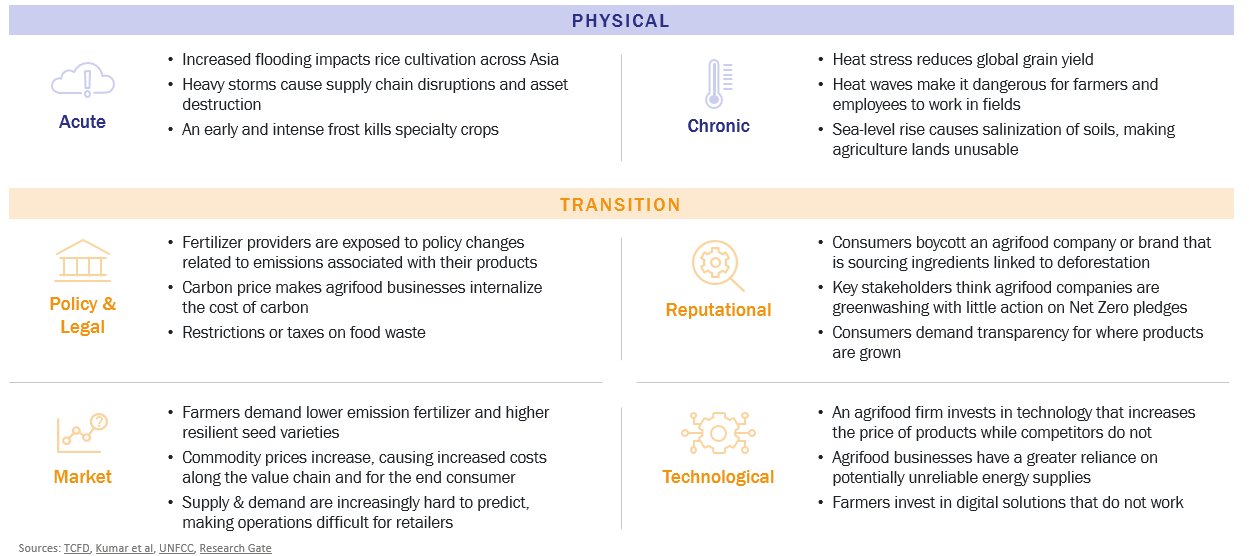

So what do we mean by climate risks? The Task Force on Climate-related Financial Disclosures (TCFD) breaks climate risks into two buckets: physical risks and transition risks. Physical risks are typically caused by weather and can be acute or chronic: acute risks are event-driven risks like floods whereas chronic risks are longer-term shifts in climate patterns. Transition risks are inherent to the transition to a low or no carbon world, and can be policy & legal, market, reputational, and technological. The below table offers examples of these risks that agrifood players face.

As you can see from the examples above, physical risks are more likely aggregated during production, transportation, and storage, while transition risks are more dispersed throughout the value chain with some players at higher risk than others.

There is good news: exposure to the risks outlined above can be reduced through mitigation and adaptation solutions, which are core to Buoyant's investment thesis. More specifically, transition risk is a driver for mitigation, because lowering or abating GHG emissions lowers risk of policy intervention, changing consumer preferences and supply chain disruptions. And physical risk is a driver for adaptation, as building resiliency in soils, supply chains, and food security will allow for protection against changing weather patterns and events.

SOLUTIONS IN AGRIFOOD (MARKET MAP)

There are numerous early-stage startups providing digital solutions to climate risk for agrifood players across the value chain. Buoyant mapped early-stage opportunities below across risk type and solution category. The below market map does not include the animal protein value chain or heavy hardware solutions. This is not an exhaustive list but is rather meant to be illustrative.

LOOKING FORWARD

It’s clear now more than ever that we must build resilient soils and supply chains, use data to enable climate smart products and services, de-risk the transition to climate-smart practices through better support, financing and insurance options, and so much more. At Buoyant, we are optimistic about the future of digital agrifood and are looking forward to supporting founders in this space. We are actively digging into these solutions so if you are a solution provider or startup in the space, please reach out!

Buoyant Updates:

Joanna Taddeo joined Buoyant as our Executive Assistant. We are thrilled to have her on board!

Stefan Oliva & Ria Panjwani joined Buoyant as summer associates. Stefan is completing his MBA from Yale SOM and Ria is completing her undergraduate degree from Brown University.

Amy & Allison have both recently spoken on panels about climate, investing, and AI at the Milken Institute Global Conference and Transition-AI by Post Script Media.

What we are reading…

Amy was featured in the Wall Street Journal talking all things climate and AI. Read more here

The A.I. Revolution Will Change Work. Nobody Agrees How by the NYT

How Much Energy Do Data Centers Really Use by Energy Innovation

MythBusters on EVs vs ICE vehicles from the EPA

What we are listening to…

The Carbon Copy’s dive into why Texans are trying to crush wind and solar

Bloomberg’s fantastic interview between Akshat Rathi and Jigar Shah about some of the technologies that he believes will be relevant in the coming decades based upon their funding activities

The Interchange’s podcast into what’s driving the growth of the US Solar Industry