2024 Outlook and Data Center Deep Dive

Buoyant is kicking off 2024 by sharing our predictions on venture and climate industry trends, and some initial research on data center energy efficiency (hint: it’s one of our predictions for 2024)

2024 Outlook

Climate Predictions:

2023 was the hottest year on record. With El Nino expected to last through April 2024, the warming impacts will be experienced throughout 2024, resulting in more catastrophes such as heatwaves, floods and droughts. The insurance industry will be hit hard, and customers and states will call for reform.

Melting permafrost and shrinking glaciers are posing risks not well understood by scientists. Frozen pathogens will thaw and affect environmental health and prosperity near arctic communities and beyond. Expect a number of scientific alarm bells to be rung about this in 2024.

Emissions will still increase, sadly, and the 1.5C limit will become harder to achieve

To retain the 50% chance of a 1.5C limit, emissions would have to plunge to net zero by 2034, far faster than even the most radical scenarios.

ClimateTech Investing and AI Predictions

Climate investing will surpass 2023 levels, with a focus on carbon capture and hydrogen as oil majors spend big on these categories. While 2023 saw an increased number of bridge rounds and down rounds, 2024 will continue this trend as companies that raised in 2021-2022 run out of cash and need valuation adjustments. Although the IPO market will be more active in 2024, this will take some time to trickle down and impact early-stage valuations.

The 2024 market will continue to prioritize profits over growth. Series B companies will need to show a path to profitability during their fundraise. However, the best startups will have no problem raising oversubscribed rounds at a premium as many companies will be raising bridge rounds. The focus on profitability will also be true for public markets and the queue of companies waiting for IPOs.

Domain and industry-specific AI offerings will increase as startups and LLM pioneers deliver easy to use models built on specific data sets (energy, weather, scientific invention, manufacturing, etc). This is being described as AI Co-pilots for services. This will create opportunities for Buoyant to invest in some of these impactful models that can accelerate the decarbonization of every industry. Expect to see applications tailored for training industrial talent, driving energy market transactions, facilitating regulatory compliance, and speeding up the scientific discovery of new sustainable materials and food ingredients.

The demand for computing power and storage space in data centers will continue to increase rapidly and decarbonization solutions for this sector will remain elusive. See below for Buoyant’s initial research into the energy intensity of data centers. We are actively looking for investments in this category, and will be announcing a new investment soon.

Volatility continues with increasing influence from climate change

Over the past few years we have seen increasing impacts from climate change on our world. Many of these impacts have collided with geopolitical or market events creating unexpected disruptions. A great illustration of this was France's recent Dijon mustard shortage caused by a Canadian drought and Russia's invasion of Ukraine. While mustard is an entertaining example, we expect there to be more serious supply chain issues as well as market and commodity volatility due to an increasing number of climate change events that will collide with geopolitical tensions and elections.

We start to see who is serious on climate change commitments

Death by pilot now means greenwashing, if you don't scale it isn't real. This combined with the conservative backlash on ESG and DEI will cause some corporations to backpedal on their commitments. Alternatively, some companies will double-down on decarbonization plans to demonstrate industry leadership and to follow-through on commitments made to employees and shareholders. We will be focused on working with those leaders.

BUT...the SEC will continue to delay guidance on climate disclosure. While new California disclosure laws will cover most major US companies and multiple EU regulations will come online.

The climate conversation will become more nuanced within the climatetech world and a deeper level of solutions develop, specifically we are expecting to see

AgTech start to take biodiversity seriously

Real estate and the built environment sector tackle the topic of embodied carbon and how to account for emissions outside of building operations

The energy sector will need to take on hourly matching to help meet new green hydrogen incentive requirements and avoid greenwashing accusations.

And generally we'll see more solutions built off of climate intelligence, such as insetting, as companies look to have impact that they can control, and increasingly detailed climate models that support better insurance pricing & reform

Batteries will continue to garner investment as advancements in storage chemistries enhance the appeal of electric vehicles and the flexibility and resiliency that they offer the grid continue to deliver on long awaited expectations.

We remain concerned about the strength and credibility of the voluntary carbon markets that are trading a large number of low-quality offsets. In 2023, we saw the beginning of a market correction from buyer pull back; however, we expect a further correction to occur in 2024. We are more intrigued with insets that represent carbon reductions in corporate supply chains which contribute more directly to net zero plans. We expect the carbon insetting market to grow in 2024.

We’d love to hear from you if you have comments or questions about this outlook or if you want to share some predictions of your own: team@buoyant.vc

Research Deep Dive: Data Center Decarbonization

In this section, we will dive into data centers, which have been making headlines recently due to their exponential growth. While they power the digital age we live in, there's a side to data centers that often goes unnoticed - their significant climate implications.

Demand for Data Centers and Climate Impacts

The demand for data centers has surged with advancements in technology, most notably artificial intelligence (AI), cryptocurrencies, remote work, and autonomous technologies. The United States is home to 57% of the world's data centers, while demand globally is projected to grow by ~10% annually until 2030.

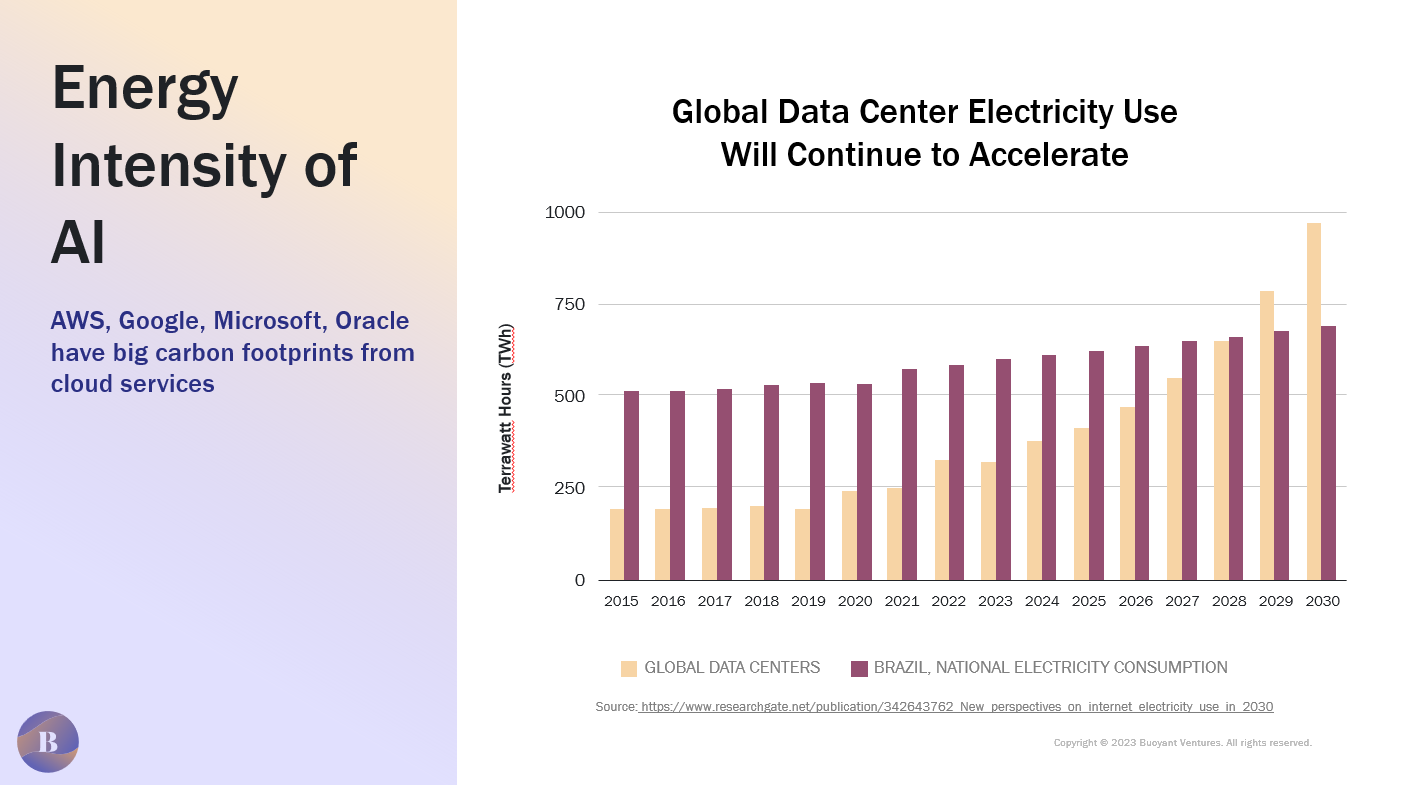

Data centers, while vital for the digital age we live in, come with a large environmental cost. By 2030, data centers are projected to consume a staggering 10% of the global power supply and consume more electricity than the entire nation of Brazil, shown below. The AI boom of 2023 raised concerns over the amount of energy LLMs require when training on massive datasets and performing computations, because they operate on power hungry graphic processing units (GPUs). Further in Texas, crypto-miners are seeking grid connections for data centers which is approximately 27% of Texas’ peak power demand.

Given this, data centers contribute about 1.5% of global greenhouse gas emissions, on par with the airline industry, and this number is expected to grow. More surprising, U.S. data centers alone consume twice the amount of water used annually by Coca Cola globally.

Emerging Solutions

So, what are the best methods of lowering emissions from data centers? Similar to farmland, the best approach is to optimize what we already have and avoid building new data centers. If new data centers must be built, they should be built close to low or no carbon energy sources, such as renewable energy + storage, geothermal, hydropower, and more.

For data centers in existence today, the majority of emissions come from Scope 2 and Scope 3 according to a study done by Schneider Electric. The exact percentage of emissions from each varies widely, depending on the age of the data center, the amount of renewables in use, and the type of data center.

Lowering Scope 2 emissions from data centers revolve around energy procurement and energy efficiency, while lowering Scope 3 emissions of data centers involves both upstream and downstream goods such as purchased equipment and hardware and energy related activities not included in Scope 1 and 2. As these solutions are adopted, they must build a business case to be implemented and cannot rely on sustainability merits alone. In addition, they must meet computing requirements such as low latency and redundancy in our increasingly connected world. A snapshot of potential solutions are outlined below - please note this is not an exhaustive list of solutions or innovators:

24/7 Energy Matching: Microsoft and Google have committed to 24/7 carbon free power by 2030, which is an ambitious goal beyond 100% clean energy. Achieving 24/7 carbon free power requires hourly matching, rather than annual netting, which today is difficult to track given variability in renewables and the infrastructure required. Startups trying to solve this problem include Granular Energy, CFEX and Renewabl.

AI Co-Pilots for Data Centers: Leveraging advancements in AI, startups are creating co-pilots to optimize day to day operations of data centers, such as Phaidra and FLUIX, which claim to lower energy costs.

Database Software: New database and analytics software companies are building innovative infrastructure to lower the cost of computations and related energy required. One company in the forefront is Ocient.

Design and Construction: Companies are tackling how data centers are built, down to airflow, HVAC systems, and other equipment, such as BitHexaOcta.

Equipment and Hardware Purchases: Incumbents and startups alike are creating equipment that consumes less power, processes data faster, and/or are creating cooling alternatives, such as MangoBoost, Euto Energy, Infinidium, among others.

Other Energy Related Activities: Data centers produce a lot of heat, which is why cooling is so important. Companies like Deep Green are creating heat recapture solutions which can be repurposed for other heating needs, while Impact Cooling is creating a direct-to-chip air cooling solution.

Building a startup in this space? See something we missed? We’d love to hear from you!

Portfolio Company Updates

FloodFlash has recently been covered in both the TIME and WSJ

Christopher Naismith, CEO & founder of Audette, was interviewed about challenges and opportunities facing climate tech founders

The partnership between Shifted Energy and Swell Energy to expand VPP capabilities was announced

Raptor Maps was selected as part of the 2024 Global Cleantech 100 List! You can download the report here.

Looking for a job in climate tech? Check out our job board. Audette and Raptor Maps are looking for Engineering, Product and Sales talent to join their teams.

Buoyant Updates

Below are some upcoming events Buoyant will attend:

ESG and Decarbonizing Real Estate Forum February 8-9, 2024, Nashville, TN

Distributech February 26-29, 2024, Orlando, FL

Be on the lookout for 2 new deal announcements in the next few months!

What we are reading…

Recent report on ClimateTech Investing trends found that women represent 66% of GPs at climate tech funds, which is over 4X found across the national VC landscape

Ann Arbor’s plan to use microgrids to bypass DTE and meet their 2030 goals

What we are listening to…

Learn more about Buoyant’s portfolio and our own start up journey on The Green Light’s interview of Allison Myers:

Is AI really a game-changer for energy by the Energy Gang

What we are watching…

You are What You Eat - A Twin Experiment is a documentary about the benefits of a plant-based and organic diet, studied across 20 sets of identical twins. Eating a healthier diet with less meat is not only good for the environment but can help repair damage to organs and make us younger.

These predictions and recap are spot on.